What is innovation? If you ask different people this question, you’ll probably get a range of different answers. From something new or novel to something that completely reshapes a business, an industry, or the world.

To put it simply: Innovation is a new way of creating value.

This can take many forms, from creating value for shareholders through higher margins, to creating value for customers with better products or services, or even creating value for team members with improved systems and processes.

This once seemed like a luxury — an afterthought — for firms that were focused mostly on growing the existing business. But, this is no longer the case.

Because of the rate of innovation and the rapid growth of well-funded startups, market leaders are facing enormous threats from outside competition. And the only way for these firms to maintain their position is to find ways to innovate — to uncover new market opportunities for creating value.

For firms in a competitive market, innovation isn’t optional.

The Death of Giants

Once upon a time, incumbent firms could use their size and resources to muscle out competitors, stave off scrappy upstarts, and maintain market dominance. But this dynamic has shifted.

As new channels, strategies, and technologies emerge, companies are able to more quickly emerge from seemingly nowhere to dominate existing markets and build new ones from thin air.

Zenefits launched in 2013 and rapidly scaled to more than 2,000 customers. Now, their cloud platform for managing benefits and HR is valued at more than $4.5 billion — in less than 5 years!

And they’ve taken a bite out of major market players in managed benefits like ADP, Paycor, and Sage. This is indicative of a much bigger trend.

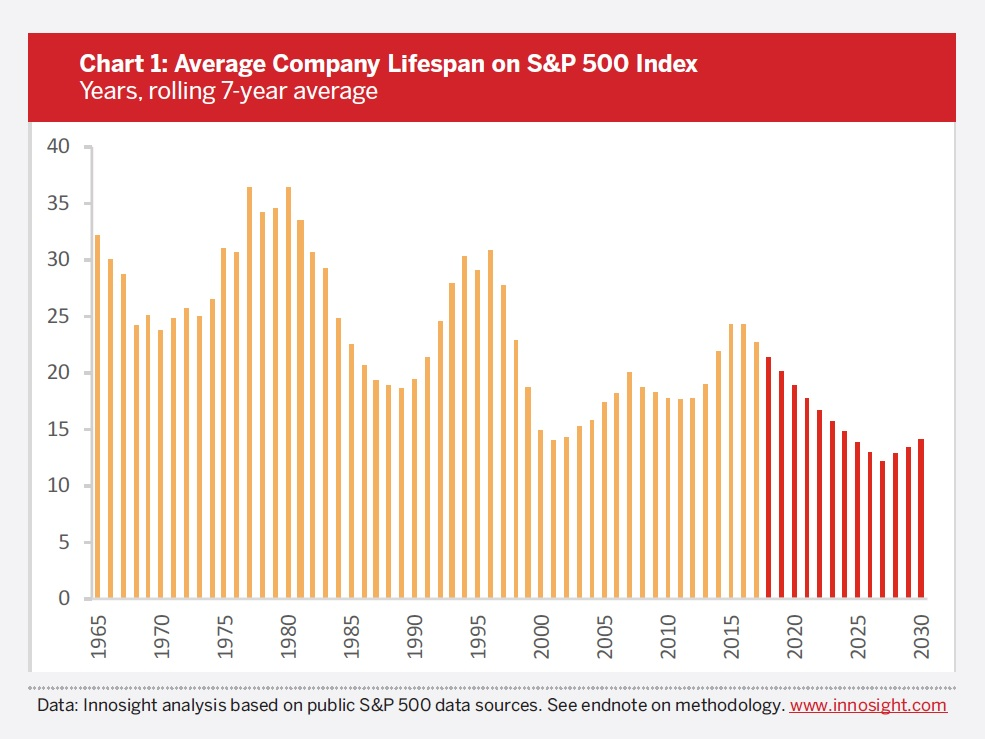

The lifespan of the S&P 500 is in freefall.

Firms that made it into this coveted arena once stayed there for 30+ years. Today, market leaders are averaging a tenure of just 10 years. This tells us that those at the top are staying there for less time, being replaced by new entrants to the market.

Average Company Lifespan on S&P Index

This is market churn — industries are being upturned and rebuilt every decade.

This points to the hard truth that most firms must face, which is that they will have to fight harder than ever to maintain their market position. They are facing enormous outside pressure and must respond by meeting — or exceeding — the pace of innovation that’s happening in the market around them.

This trend is just a symptom of the larger, seismic shifts that are driving the need for innovation.

Companies and being built, growing, and being replaced faster than ever.

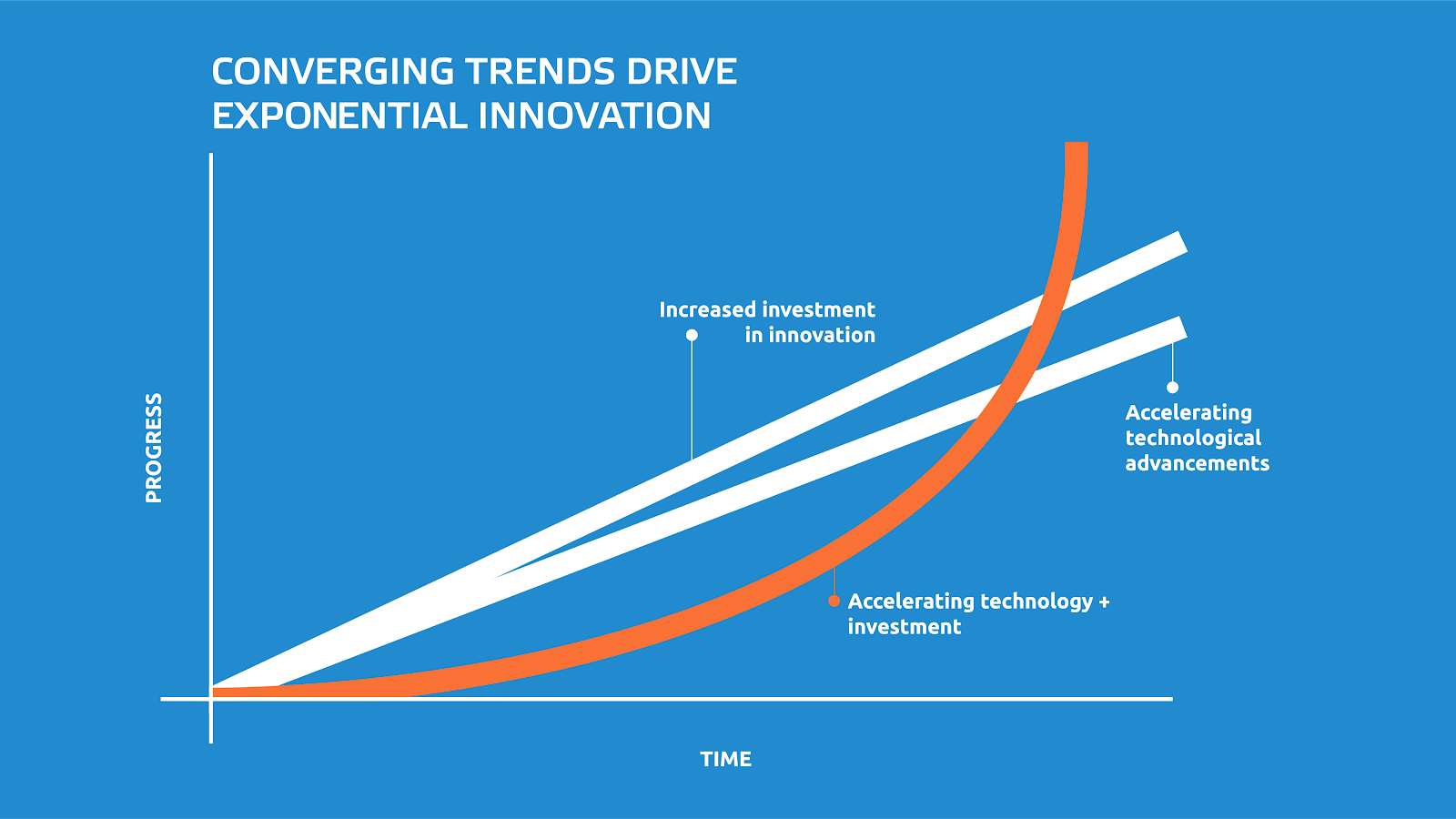

These changes are being largely driven by two main factors:

- Accelerating technology advancements

- Increased capital investment in innovation

Combined, these two forces mean more innovation is emerging in more areas of more businesses. The convergence of these trends is driving an exponential rise in the rate of innovation across all markets, which in turn drives the need for existing firms to innovate in order to stay competitive.

It’s a game of innovate or die.

Innovation All Around Us

One of the biggest forces driving innovation and market disruption is the emergence of several game-changing technologies.

Just like with the invention of computers and the internet, new technologies bring about a wave of innovation across markets and industries.

5 Emerging Technologies Driving Innovation

- Artificial Intelligence

- Virtual Reality

- Internet of Things (IoT)

- Wearable Tech

- Advanced Robotics

At this point in time, we are seeing the wave of innovation being driven by several concurrent emerging technologies: Artificial intelligence, virtual reality, IoT, wearable tech, and advanced robotics are all at play. Every market sector is seeing core business operations being overhauled or disrupted by these trends.

On its face, new technology does not necessarily pose a threat if all firms have an equal opportunity to capitalize on these opportunities. But incumbent firms often struggle with institutional momentum that makes it difficult for them to adopt new technology or develop and execute new strategies.

This leaves the window open for startups and competitors to swoop in. And they’re doing so in droves. Particularly in the startup market, we see that venture capital is driving a venerable sea of new businesses built on these new technologies, bringing them to market much quicker than even well-resourced corporations.

Capital Drives Changes

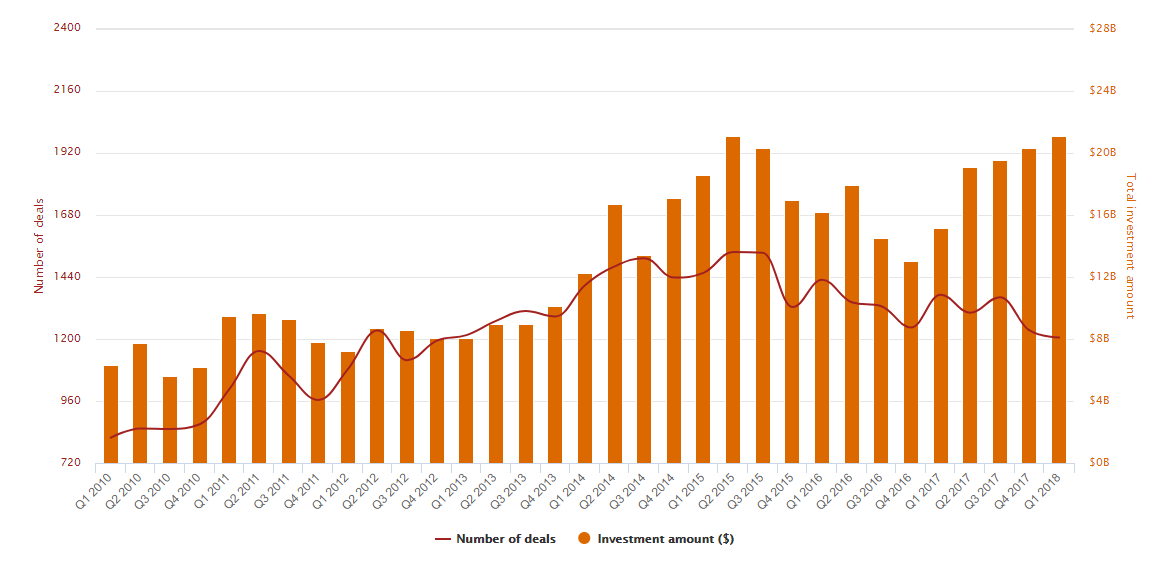

The second force driving innovation is the capital investment flowing into early-stage, innovative startups.

While the introduction of new technology alone may not represent a major threat to market leaders, venture capital is rapidly accelerating the pace of innovation and the ability for startups to build and scale their businesses. This means new firms are coming to market more quickly, and growing aggressively, often siphoning off market share from incumbents.

Total investment in US venture-backed companies

Total investment in US venture-backed companies ticked up 17% in 2017 over the prior year. In total, almost $72 billion was funneled toward early- and growth-stage startups across all verticals and industries.

This kind of capital is empowering more firms to come to market and scale rapidly.

United Masters, for example, is a New York startup that’s taking aim at traditional record deals and major record labels like Sony, EMI, and Warner Brothers.

This has been attempted many times over the years by fledgling independent labels, music collectives, and unsigned musicians trying to carve out a niche without a record deal.

But United Masters is a different beast. The firm just snagged a $70 million Series A round, which will buy them a lot of leverage and runway to build something that can compete with international conglomerates.

This influx of cash is helping small startups take a run at companies in nearly every industry — and that likely won’t change any time soon.

Innovation is Here to Stay

Some firms will look at these trends and think that they’re just a blip — that things will change in a few years.

But that’s not the case.

While there may be ups and downs in venture capital markets, the rate of technology development won’t be slowing down anytime soon.

And as long as there is new technology being developed that can create value in new and interesting ways, there will be new companies and startups looking to capitalize on those opportunities.

There’s no “waiting it out” when it comes to innovation. The only way to deal with the rising tide is to start swimming.

The best way for corporate firms to get ahead of these trends is to invest in innovation. And they can jump start this process by working with — and learning from — startups.

(originally published May, 2108 on Medium)

GET THE LATEST RESOURCES

Get the latest episodes of the Inside Outside Innovation podcast, in addition to thought leadership in the form of blogs, innovation resources, videos, and invitations to exclusive events.